STORY BY BRITTANY PREOCANIN

Being a student definitely comes with its perks—the responsibility, life experiences and decision-making, from day one to the day we graduate.

We walk through these doors into a chaotic world of classrooms, time management, due date submissions and late night studying. On top of that, students get to look forward to scheduling around part-time jobs, dealing with friendships and relationships and best of all, meeting expenses.

Most of us have been classified as the “poor student,” and after several years the negative connotations of such a label can be embarrassing. Below is a money guide, from one student to another, that will help you get through the next few years of post secondary school without breaking the bank.

Student Bank Accounts

Most of us have had a bank account since our first jobs, roughly around Grade 9 or 10. But after graduating high school, many banks require a timetable or student ID to prove you are still a student and avoid service charges. These charges cost between $10-$30 a month, which could pay for the data on our phone bills instead.

That being said, bank accounts are like phone companies, depending on where you go and sign up, you could find a better deal. CIBC for instance offers unlimited chequing, withdrawals and transfers, but costs $1.50 for each e-transfer. RBC provides five free Interac but only 25 debit transactions per month. TD Canada Trust offers 25 debit transactions while BMO ups them with 30 free debit transactions per month.

The bank that comes out on top however, is non other than Scotia. With unlimited transactions, up to five free movies when you sign up, points towards movies with every transaction and cash withdrawals outside of Canada, Scotia banking seems to be the best deal.

It’s important to remember though, that similar to phone companies, you can usually weasel a deal with bank accounts too.

The Options for Parking

For all the drivers out there who just love getting stuck in morning traffic, the one thing you get to look forward to is parking, practically right at the front door. But at what expense? Four-hundred and eighty dollars for two semesters to be exact.

The average student will work 15-20 hours per week. At $11.25 an hour, that’s an average of $202.05. So about a month later, you have the allowance for your parking pass. But that cell phone bill, credit card bill, car insurance and additional personal expenses also have to be paid.

Sheridan offers a variety of fee options, let’s not forget, so if you do have a schedule that only permits you to be here only one or two days a week, or just for evening classes, consider yourself lucky. An evening semester pass, valid for one weeknight only is $40. Daily maximum is $10, hourly is $3 and one semester is $260.

My tip to you is to stroll over to St. Simons Anglican Church across from campus for a two-semester $200 parking pass. Spaces are limited so it’s a good idea to go in first week of the year. Save yourself $280 and take the extra five-minute walk to class.

Cheaper Textbooks

The average post secondary student in Canada spends about $500-$1,000 on textbooks and course material each semester. But there are plenty of ways to save money on those textbooks that are used “extensively” throughout school.

The easiest place to look is the Internet. We are all surfing at one point or another throughout our day, so why not pop up Kijiji, Facebook or Amazon. Sheridan has it’s own Sheridan Classifieds for Textbooks Facebook page, where students post what they need and/or are selling. Another fancy site is textbookrental.ca. Co-founder Gershon Hurwitz created the site for renting textbooks, which allows you to sell used books and buy new ones. The site has 11 depots in the GTA.

While we are on the subject of selling old books to buy new ones, don’t forget to add in your study notes for some extra marketing. Your copy is sure to be bought over the copy being sold just as a book.

Opt-out Option

Then there’s the opt out. If you actually take a look at your tuition invoice, you will see fourth line down, the medical and dental plan. If you have previous coverage for health benefits, whether from your parents or someone else in your household, you can opt out of the health benefits automatically included in your tuition. Some of our parents’ health benefit plans will only cover students if we are enrolled full time, or under a certain age, usually 21 or 25.

For $280, some of the benefits offered in our tuition fee are $75 for a yearly eye exam, which, unless you are over 19 is covered under OHIP already. They also offer $150 a year for prescription eyeglasses or contact lenses. The dental plan offers 70 per cent coverage on most appointments, aside from crowns, bridges and posts. Health benefits offer only $25 per chiropractor visit, $25 per message therapist visit and $50 per psychologist visit.

If you don’t have any coverage, by all means pay the health benefits fee.

However, if you qualify to continue receiving your parents’ plan then opt out of the health benefits in your tuition and save yourself $280. The money could go towards textbooks or food for the next month.

But be on top of dates. Opt outs this year run from Sept. 1-29, Jan. 4-25 and May 11-25. Go online to ihaveaplan.ca to opt out permanently or annually.

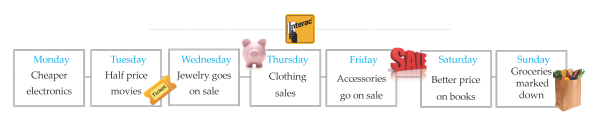

On top of tuition payments, parking passes and textbooks, some additional resources can be useful. A helpful guide from Interac can be used to help students save money based on what day of the week they go shopping.

However, as students, necessities aren’t the only thing we are spending our money on. Clothing and social events are often costly, but they too are a part of student life. The best way to save on such costs? Find the deals.

Shop Plato’s Closet

Whether it’s a season change or right before school begins, something in us – and probably marketing staff—tells us to go out and shop for new clothes. The first tip when it comes to buying new clothes is to get rid of two items for every one you buy. This not only helps your bank account but also keeps your closet from over flowing. Plato’s Closet, a franchise in Oakville, Burlington and Hamilton, allows you to bring in your gently used, brand name clothing in exchange for cash. You can either save the money you traded your clothes in for, or use it to shop in the store for new outfits.

Every location is looking for something different so checking out their Facebook page before going in with garbage bags full will remind you of what they need. Remember the season you’re in and the brand you are selling. An additional tip to remember is that select stores will allow you to opt for store credit. This store credit will earn you an additional 10 per cent on the item you are selling, as long as you spend the money in their store.

And just because Plato’s Closet is a second hand store doesn’t mean it won’t have sales. Some locations will hold a grab bag sale where you can fill a bag, provided in store, for $10, $15 and $25. Clearance items can go for half price while certain locations will hold dollar days.

Surf WagJag

If you don’t know what Wag Jag is, you need to look it up now. It offers cheap hotel prices, coupons on car repairs, restaurant vouchers, savings on hair salon services, cheap tickets for events like food and wine expos and discounts on Broadway shows. What I’m getting at is the site covers everything you can imagine, in your area, with some type of discount or saving.

For example, of you’re driving from out of town to school everyday, you know an oil change is needed about every three months. At $40 or more per oil change, you feel as though you keep investing more and more money into your car. A $50 deal for three oil changes at Beverly Tire is often available on Wag jag, saving you $70 or more.

If you live in a student house with three or more people, you can also check out their grocery deals that can save you $30-$80 on bulk products, including meat.

Even group activities like bowling, mini put or archery can be found on Wag Jag for group discounts. You can currently purchase tickets to Chill Ice House in Toronto, Screaming Tunnels Haunted House and Escape Game from Origin Room Break.

Additional Student Tips

To provide a bit more perspective, students from a few schools shared their money tips for saving and shopping on a budget. E-bates is one tip that could help all the shopaholics out there.

“You can use it pretty much anywhere you shop online. You just search the store from their [e-bates.com] website and they give you cash back,” said Kayleen Willemsen, Wilfrid Laurier University graduate.

Fashion management student, Kaitlyn Fifield said, “I opened a second savings account. My basic chequing and savings were always tempting to dip into. Having a third place to put away money has really helped.”

And then there’s coffee. Lets all remember that $4 to $5 on one cup of coffee a day adds up to about $25 at the end of the week. “Don’t buy Starbucks, that’s my main money saver,” said Julie Hoffman, Mohawk journalism student.

“Find a way to perfect Starbucks drinks at home. You can find out recipes on Pinterest,” said Lia Nardone, a graduate from Sheridan College.

While we are on the topic of making your own coffee before class, don’t forget the lunch options in the cafeteria add up over a five-day time period.

“Bring lunch to school, crappy microwaves or not. Prep some meals and save $30-$40 a week,” said Dave Lilley, Sheridan College graduate.

“If you are living alone and off residence, use flyers when you buy your groceries. Go to Walmart or No Frills as they usually price match. It adds up over time.”

If you are interested in knowing what type of person you are when it comes to spending money, take the quick quiz below.